Simplifying Tax Residency Compliance with the 183 App: A Traveler’s Guide

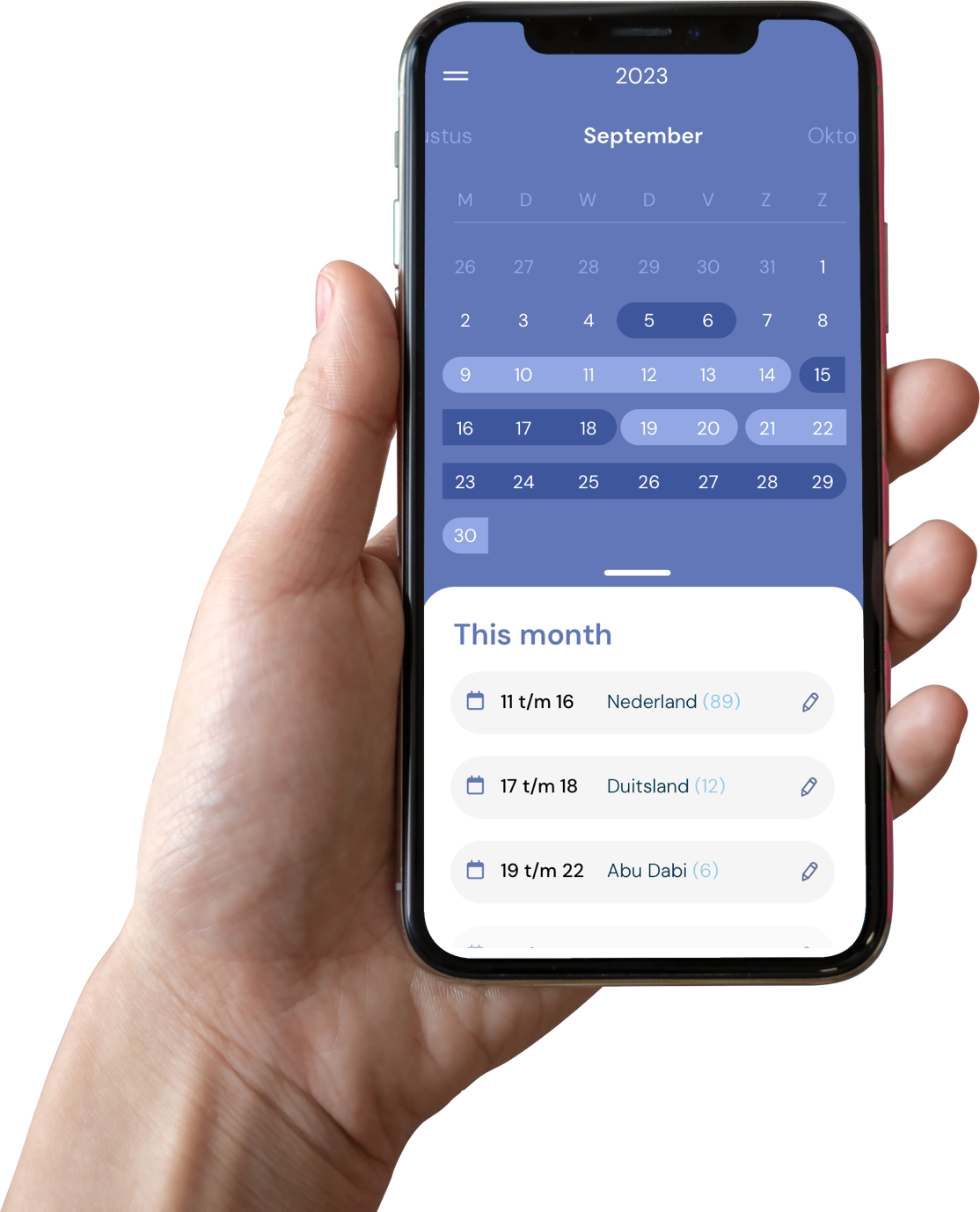

For globetrotters and international professionals, abiding by the 183 days rule for tax residency can be a daunting task. However, with the emergence of tracking applications like “183 App,” keeping a precise count of your days in various countries has become remarkably convenient and crucial for maintaining tax compliance.

The Importance of Accurate Tracking

Adhering to the 183 days rule is crucial in avoiding unintended tax liabilities and legal complications. The “183 App” ensures meticulous tracking, enabling users to monitor their stay in a specific country accurately and preempt any potential tax-related issues.

Effortless Day Counting

Using the “183 App” simplifies the process of keeping track of the number of days spent in different countries. The app provides a user-friendly interface, allowing individuals to input their travel details and effortlessly monitor their stay durations, thus avoiding the risk of unknowingly surpassing the 183-day threshold in a particular jurisdiction.

Conclusion

Embracing technology such as the “183 App” streamlines the process of tracking days for tax residency compliance, providing peace of mind to frequent travelers and international professionals. By incorporating this user-friendly tool into their routine, individuals can navigate the complexities of the 183 days rule effortlessly and ensure a seamless and hassle-free experience during their global travels.