Understanding the 183 Days Rule in Global Taxation

In the realm of international taxation, the 183 days rule serves as a crucial determinant for tax residency in many countries. Understanding its implications is vital for both individuals and businesses engaged in cross-border activities. Here, we delve into the workings of this rule and its significance across various jurisdictions.

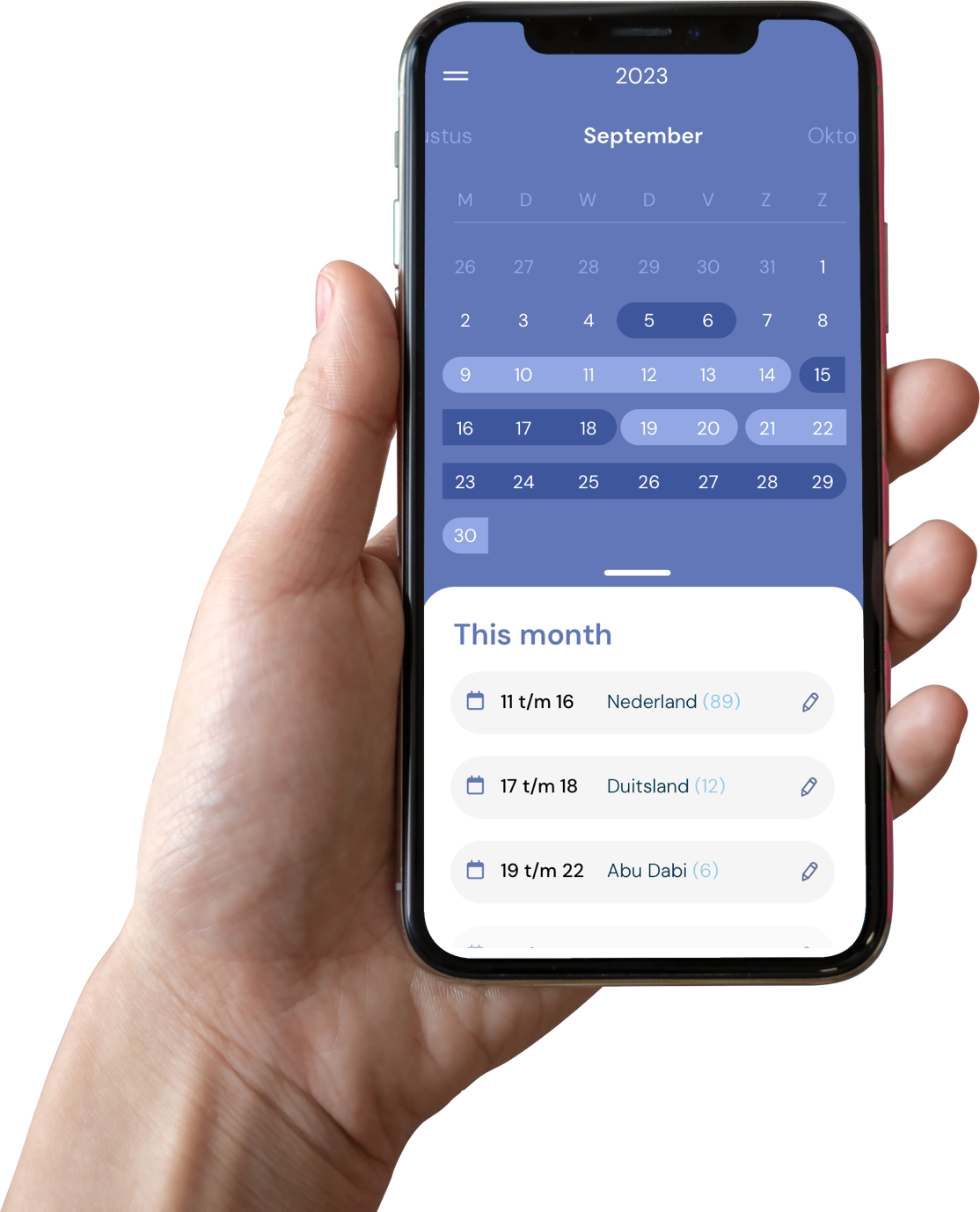

The 183 days rule is a common principle used by tax authorities to determine an individual’s tax residency status within a specific jurisdiction. According to this rule, if an individual spends 183 days or more in a particular country during a fiscal year, they are typically considered a tax resident of that country.

Application of the Rule

- European Union: In many European countries, the 183 days rule forms the basis for establishing tax residency. However, specific nuances may exist depending on bilateral tax treaties and local regulations.

- United States: For non-U.S. citizens, spending 183 days or more in the U.S. during a calendar year may trigger tax residency, leading to potential tax obligations on global income.

- Asia-Pacific Region: Several countries in the Asia-Pacific region, such as Singapore and Hong Kong, adhere to the 183 days rule as a determinant for tax residency. However, additional factors might also influence the residency status in these jurisdictions.

Exceptions and Complexities:

Despite its apparent simplicity, the 183 days rule can present complexities. Some countries may factor in other considerations, such as the individual’s permanent home location, center of vital interests, or habitual abode, which can influence tax residency status. Additionally, certain tax treaties between countries may modify or override the application of the 183 days rule.

Consequences of Tax Residency

Understanding the implications of tax residency is crucial, as it determines the extent of an individual’s tax liabilities, including income tax, capital gains tax, and inheritance tax. Failure to comply with the residency regulations may result in legal consequences and financial penalties.

Conclusion

The 183 days rule, although a fundamental criterion for tax residency determination, varies in its application across different countries. Individuals and businesses engaging in international activities must be mindful of this rule’s nuances and its potential impact on their global tax obligations. Seeking professional advice from tax experts is imperative to ensure compliance with international tax laws and regulations.