Navigating Offshore Business: The Significance of Monitoring Days Under the 183 Days Rule

For employees engaged in the offshore business, maintaining meticulous records of their days spent abroad holds immense significance, particularly concerning adherence to the 183 days rule. Understanding the importance of this practice is paramount for ensuring tax compliance, mitigating legal risks, and fostering stable international career trajectories.

Determining Tax Residency Status

For employees immersed in the offshore business, accurate monitoring of the number of days spent in different countries is essential for determining their tax residency status. Adhering to the 183 days rule plays a pivotal role in avoiding unintended tax obligations and preventing potential legal entanglements, ensuring a streamlined approach to international tax compliance.

Mitigating Double Taxation Risks

By diligently tracking their days according to the 183 days rule, offshore business employees can effectively mitigate the risks associated with double taxation. Maintaining precise records facilitates the application of tax treaties and provisions, thereby preventing the imposition of taxes on the same income by multiple jurisdictions, safeguarding financial resources, and fostering a conducive international work environment.

Managing Global Mobility Strategies

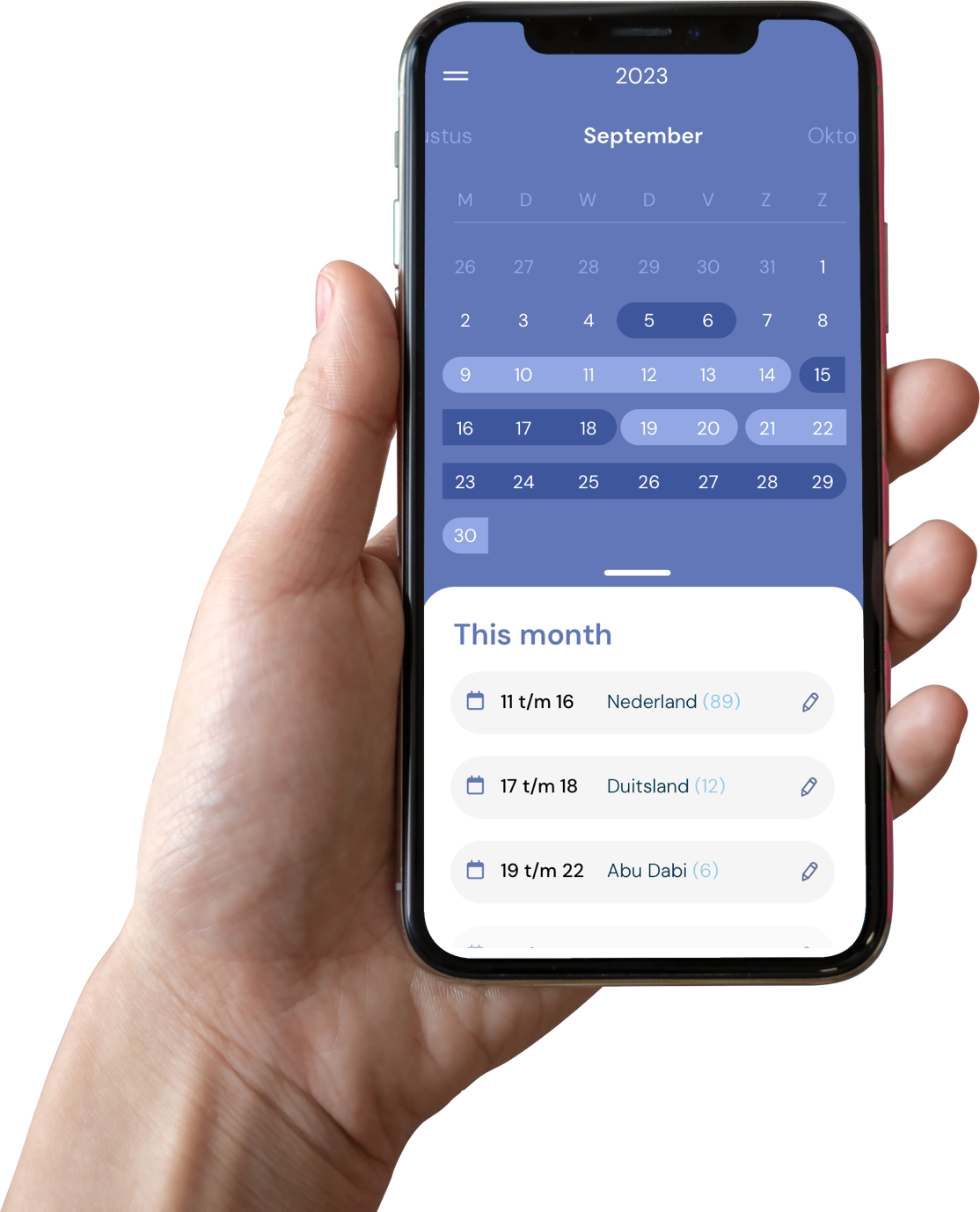

Tracking days under the 183 days rule enables offshore business employees and their employers to strategize their global mobility initiatives effectively. Maintaining an accurate record of days spent in various jurisdictions facilitates informed decision-making regarding project durations, work schedules, and international assignments, ensuring seamless business operations and workforce management across borders.

Ensuring Compliance with International Regulations

Employees in the offshore business must prioritize the meticulous tracking of their days to ensure compliance with international tax regulations and legal requirements. Proactive adherence to the 183 days rule not only mitigates the risks of legal penalties and financial liabilities but also fosters a culture of transparency and accountability, enhancing the credibility and reliability of the offshore business operations.

Securing Long-Term Career Trajectories

A disciplined approach to monitoring days under the 183 days rule enhances the long-term career prospects of offshore business employees. By prioritizing tax compliance and demonstrating a commitment to regulatory adherence, employees can build a reputation for professionalism and integrity within the global business community, opening doors to diverse international opportunities and professional growth.

Conclusion

The importance of keeping track of days under the 183 days rule for employees in the offshore business cannot be overstated. From ensuring tax residency compliance and mitigating double taxation risks to facilitating global mobility strategies and securing long-term career trajectories, diligent record-keeping serves as a fundamental practice for fostering stability, transparency, and success in the dynamic landscape of international business and offshore operations.